One of Europe’s leading alternative investment management firms.

We take pride in our people, the clients we serve and our investment expertise. Results matter but equally so do our values.

We manage over €65 billion across more than 6,000 portfolios.

Credit Opportunities Strategy (COPS)

The COPS strategy focuses on the purchase of granular, unsecured and secured consumer and SME loans. We target transactions of €5-500m across multiple asset types including credit cards, mortgages, personal and commercial loans, retail credit, auto loans, leasing and asset finance, utility bills and consumer public sector (including student loans).

COPS’ investment strategy offers a highly differentiated exposure within the private debt market through a well-diversified portfolio of performing, reperforming and non-performing loans purchased from banks, finance companies and other loan originators.

LCM’s sister company, Link Financial is one of Europe’s leading specialist loan servicers and as a Group, employs over 950 people across 12 European offices.

It has an established global network of servicing partners that offers greater coverage, providing unparalleled access to transactions and opportunities across key European and global markets.

We have a database of individual loan by loan level data on 7 million accounts across economic cycles that offers unique insights and underpins our track record of double digit, unleveraged returns.

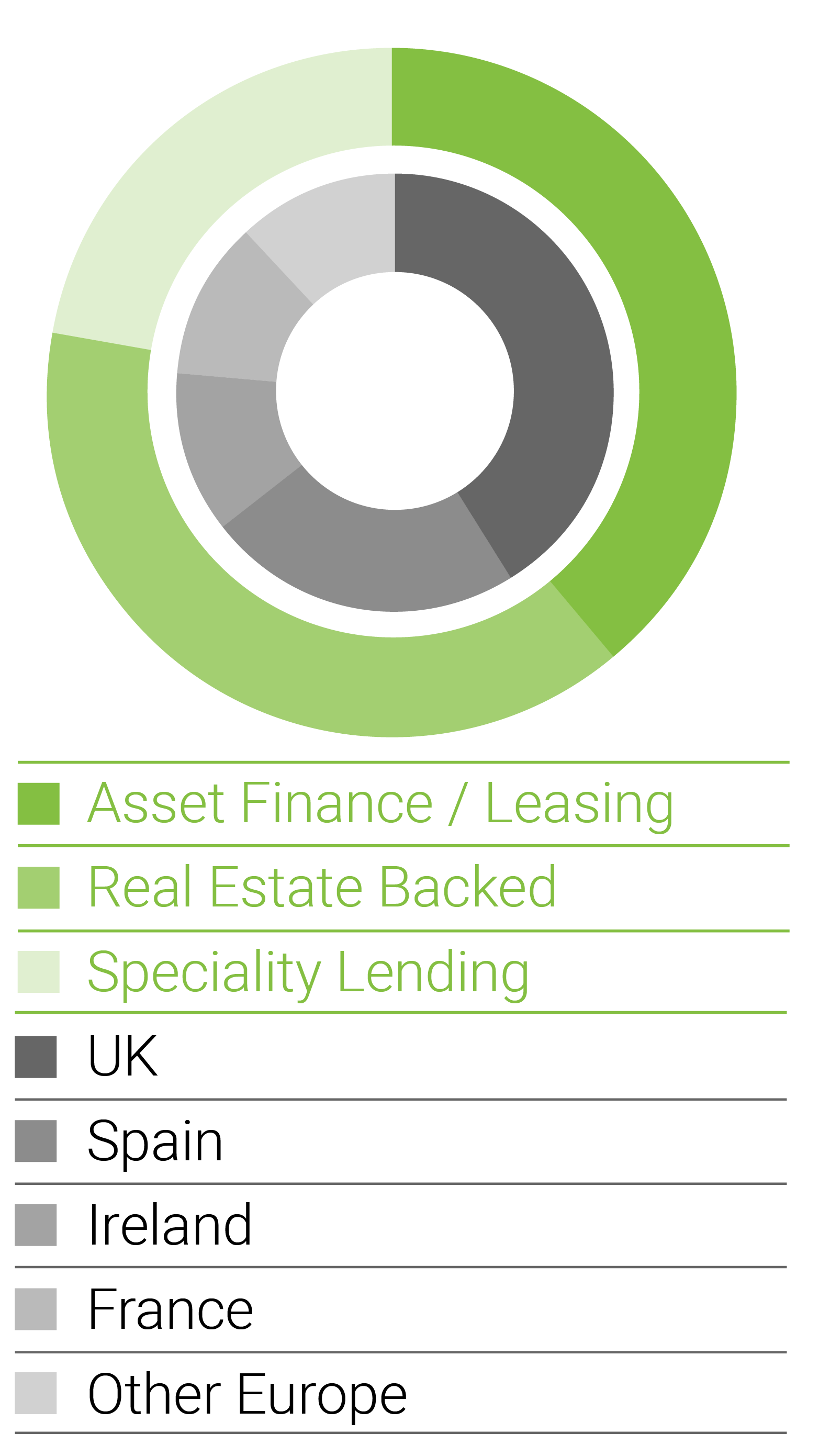

Illustrative portfolio

composition

By category and geography

Strategic Origination and Lending Opportunities (SOLO)

SOLO is a high-quality, asset-backed performing loan strategy that aims to generate robust, risk-adjusted returns.

Through SOLO, LCM forms long-term and exclusive partnerships with established originators across Europe to fund granular, high-quality, small and middle ticket loans and leases, with a typical advance of between €5,000 – €5m, to SMEs and individual borrowers.

The SOLO strategy targets a diverse range of attractive segments within secured loans, asset finance and leasing and select smaller ticket products which now fall outside the remit of banks and other traditional lenders.

As well as capital, LCM Partners are perfectly placed to provide originators with a full operating solution, leveraging the group’s technology, servicing platform and experience managing granular and difficult to manage loans.

LCM Partners recognises the importance of Environmental, Social and Governance (ESG) issues, both in the way we invest and in the way we manage our investments.

Our performance is a direct result of the expertise of our team.

Paul Burdell Chief Executive Officer

Octagon Analytics, European Central Bank, JP Morgan

Chase, DLJ, United Bank of Kuwait

1998

Selina Burdell Chief Operating Officer

Octagon Analytics

1998

Adrian Cloake Chief Investment Officer

Arthur Andersen Corporate Finance

2002

Fernando Yáñez Chief Strategy Officer

JP Morgan, Sidley Austin, Basham

2015

Samuel Burdell Managing Director

AgFe

2016

Pier Paolo Radaelli Managing Director

AnaCap, Oliver Wyman, Merrill Lynch

2012

Declan Reid Managing Director

Irish Government, Ondra, Dresdner Kleinwort, Lehman, BBH

2017

Farid Shavaksha Managing Director

S&P, Morgan Stanley, Simmons Gainsford

2013

Adrien Tonnot Managing Director

Deloitte Corporate Finance

2014

Juskurran Hothi Investment Director

BlackRock

2015

Erwan Le Youdec Investment Director

PWC, Blantyre Capital, SC Lowy

2021

Maxime Saunier Investment Director

BNP Paribas

2019

Ilaria Vignozzi Transaction Execution Director

S&P Global Ratings, Intermonte SIM

2015

Gordon Watters Chief Risk Officer

Ares Management, Barclays, Credit Lyonnais, Bank of Scotland

2013

Josephine Bennett General Counsel & Head of Compliance

Henderson Global Investors, Kantor and Immerman

2013

Lucinda Glazebrook Legal Director

CMS

2015

Kairi Malaspina Legal Director

CMS

2017

Angel Tovar Head of Portfolio Management

BBVA, T-Systems (Deutsche Telekom)

2007

James Hogan Managing Director - Investor Relations

HSBC, Mojna Capital

2016

Robert Bradburn Head of Fund Operations

EQT, AIG, TDR Capital

2018

David Gregory Head of Fund Finance

Perrys Chartered Accountants, Augentius Fund Administration (IQ-EQ)

2014

Graeme Laing Managing Director - Asset Finance

CSA Financial, Bank of London and The Middle East

2017

Latest News

1 September 2023

10 July 2023

27 February 2023

8 September 2022

15 February 2022

14 September 2021

9 March 2021

2 July 2020

11 May 2020

31 March 2020

Our excellence in fund management has been recognised through a number of prestigious awards and nominations.

Awards

Join a world class team.

Careers

Join a world class team.

At LCM Partners, we are always looking to hire and develop talented professionals who want an environment where they can be creative, ambitious and have a real impact.

Our expertise in credit investment and commitment to excellence are why we are regarded as pioneers in our industry.

If you enjoy being challenged and want a rewarding, exciting career in alternative investment management, then we want to hear from you.

Send your CV to: [email protected]

Information about how we manage your data when you apply for a role

Current Vacancies:

Contact us

LCM Partners

11 Belgrave Road, London

SW1V 1RB

Phone: +44 (0)20 3457 5050

Email: [email protected]

LCM Partners Ltd

11 Belgrave Road,

London SW1V 1RB

LCM Partners Limited (8044232) and LCM Capital LLP (OC 357678) are registered in England and Wales with registered offices at 11 Belgrave Road, London SW1V 1RB. LCM Partners Limited (FRN: 706257) is an Appointed Representative of LCM Capital LLP (FRN: 534658) which is authorised and regulated by the Financial Conduct Authority. LCM and LCM Partners are the names under which these entities provide investment products and services. The information on this site is issued and approved by LCM Partners Limited. We may record telephone calls for our mutual protection and to improve customer service. ©2023, LCM Partners Limited.